Contributed by Sean Riley, COO of Transnova

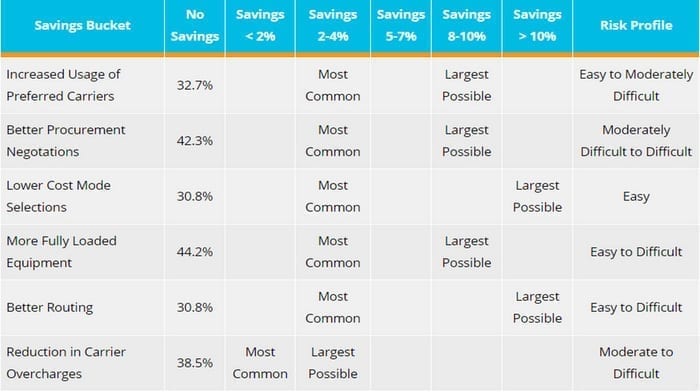

In South Africa, the number of companies that utilise a Transportation Management System (TMS) to manage their transportation is low compared to our European and US counterparts. But this is rapidly changing with the arrival of Software-as-a-Service (SAAS) based TMS systems that are cost effective and quicker to implement. Perhaps no other supply chain application offers so many ways to drive value as a TMS. A few years ago, the ARC Advisory Group surveyed and talked to over 50 companies that had implemented a TMS to understand the ROI. Over 40% of respondents reported freight savings of between 5 and 10% while 23% reported freight cost reductions of over 10%. Perhaps the most important chart in this report showed the key areas where a TMS can reduce a shipper’s transport spend, and the potential cost reductions driven by those different savings buckets. But there are so many ways a TMS can drive logistics savings, trying to drive savings in all areas in an initial implementation would greatly increase the chances of having a failed implementation. So a key question becomes: on which areas should a company focus initially? This depends partly on a company’s strategy. But it also makes sense to focus on areas where the savings potential is greater while the chances of failure are lower. The following table shows our analysis of the risks and rewards associated with driving transport savings in the different areas. In a few of the categories, the risk described is “Easy to Difficult.” In these categories, it is easy to drive a certain level of transport savings with basic functionality, but difficult to implement the most advanced functionality. For example, routing is one of the two areas in which the largest numbers of respondents get their savings. Outbound, multi-stop Truck Load (TL) routing is the most common form of routing and its prevalence suggests that most TMS suppliers do not have problems supplying savings in this area. However, jointly routing inbound and outbound shipments to reduce empty miles, or jointly routing carriers and private fleets, can be very complex. In these different savings categories, a TMS achieves savings based on visibility, process enforcement, analytics, and optimisation. Visibility is a key driver of transport savings. This is made possible through a multi-tenant, network-style TMS that captures anonymous data on all the moves, made by all clients, on all lanes. Customer data is aggregated in a manner that protects the privacy of individual shippers, while allowing for the creation of lane benchmarking rates. Customers are, therefore, able to access current lane benchmarks, as well as historical trends – a vital tool for optimising the transport network and negotiating the most competitive rates. In South Africa, customers can now access this same capability. As an example, a company whose initial focus was to use the TMS for tendering, routing and optimisation could harvest the information from its TMS to drive better transportation procurement. Working with TMS full-service providers, companies can leverage Managed Procurement Services and benchmarking data. This can then be used to compare the rates being offered by the carriers to industry benchmarks. When it comes to visibility like this as a driver of transport savings, it is hard to beat the new breed of network-based, SaaS TMS solutions.South Africans missing out on TMS benefits

Mar 30, 2015 |

Cross Border

Supply Chain Logistics

Transport & Logistics