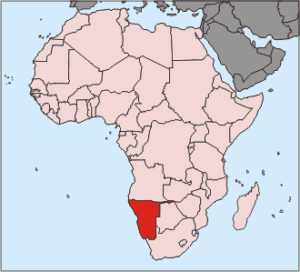

BMI’s forecast for the Namibian freight transport sector is positive, in both the near and longer term.

Domestic economic growth and an expanding mining sector will continue to drive demand within the country, while continuing investment in freight transport links – both road and rail – with hinterland countries such as Botswana and Zimbabwe will see transit volumes grow. The Namibian economy will post solid growth of 5.3 % in 2015 and 5.5% in 2016, and expand by around the same pace annually over the next five years, which will naturally drive growth in freight volumes. There are risks to the downside in the near term, as falling commodity prices could forestall investment into the mining sector, and the government attempts to rein in escalating household debt levels. Nevertheless, BMI believes the outlook across all freight modes is positive. Air freight will see the strongest growth levels, albeit from a particularly low base. Headline Industry Data • Total trade is expected to see a real contraction of 0.7% in 2015, returning to growth at 1.7% in 2016• Road freight will increase by 7.2% in 2015 and 7.0% in 2016. Volumes will reach 65.46mn tonnes in 2015

• Rail freight will grow by 2.6% in 2015 and 2.7% in 2016. Volumes will reach 1.35mn tonnes in 2015

• Air freight volumes are forecast to expand by 5.5% in 2015 and 5.4% in 2016. Volumes will reach 123,010 tonnes in 2015. According to BMI’s Sub-Saharan Africa (SSA) Country Risk team, Namibia’s total trade will see a decline in real terms in 2015, dropping 0.7%. This will be driven by a drop in imports, although exports will see flat growth of 0.2%. In 2016, there will be real growth of 1.7%, as exports pick up with a 3.2% increase, while imports return to growth, albeit sedate at 0.1%.

BMI expects Chinese thirst for uranium will counterbalance some of the negative effects of a slowdown elsewhere. The Husab Uranium mine project bodes BMIll for uranium output in the coming years. In 2017, BMI forecasts that total trade will pick up with a real expansion of 6.9%, and will remain positive over the remainder of our forecast period to 2019.

In 2015 BMI forecast that road haulage volumes will increase by 7.2%. If the BMI forecast is borne out, 65.46mn tonnes will be transported on the Southern African country’s roads over the course of the year. In 2016 BMI forecast that growth will remain at broadly the same level, forecast a 7.0% expansion and gross tonnage of 70.03mn tonnes. Road haulage is overwhelmingly the largest freight mode in Namibia, in terms of both volumes and the network on which it is carried. Investment in mining will be the primary driver of growth in rail freight volumes in Namibia in both the near and long term. This is not only the domestic mining industry but also that of landlocked hinterland states, in particular, Botswana. BMI forecast rail freight volume growth of 2.6% in 2015 and 2.7% in 2016. Growth in Namibian air freight volumes will be robust in 2015 and over the course of BMI’s medium-term forecast period to 2019, thanks to rising consumer demand. The sector is underdeveloped at present, and BMI forecasts are predicated on the assumption that investment will be made into improving the country’s infrastructure. At present, the country is over-reliant on neighbour South Africa’s facilities for linking with the rest of the world.