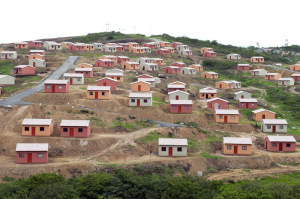

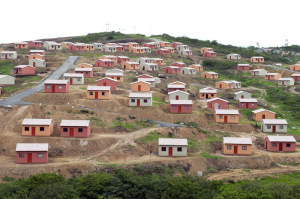

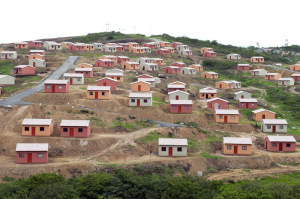

Though African governments are providing housing to meet the demands of growing urban populations, these programmes are extremely costly to them and out of reach of the urban poor

With 60%-70% of urban households living in informal settlements, the bank has called for new, targeted approaches to affordable housing if the countries are to make cities inclusive, spur economic growth and create jobs.

Rapid urbanisation, climate change, threat of terrorism and inadequate infrastructure are some of the challenges delegates at Africities Summit 7 have been grappling with since Sunday November 29.

The report, titled

Stocktaking of the Housing Sector in Sub-Saharan Africa, stresses that new approaches to housing policy are needed.

“In many African countries, only the upper 5%-10% of the population can afford the cheapest form of formal housing,” says World Bank Senior Director Ed Jorge.

“As a result, 90% of Africans live in informal housing, where living conditions are often substandard, unsafe and

without basic services like water, electricity and sanitation.

“This report demonstrates that targeted interventions in the informal market can bring rapid improvements in the quality of existing housing stock in a number of African countries,” says Jorge.

Housing programmes out of reach for urban poor

Though African governments are providing housing to meet the demands of growing urban populations, these programmes are extremely costly to them and out of reach of the urban poor.

These efforts have not significantly increased the amount of affordable housing.

The report recommends that scarce government resources should instead target informal housing in low-income areas and households – upgrading infrastructure, improving land administration and planning regulations, and expanding access to finance through microfinance loans, credit groups and credit cooperatives.

Only 5% of adults in Sub-Saharan Africa obtained a loan from a formal financial institution in 2014, half the rate of other developing regions such as South Asia or East Asia and the Pacific, said the report.

“Apart from the immediate and obvious benefits of adequate housing, a well-functioning housing sector leads to economic growth that can improve livelihoods, create jobs and expand the market for goods and services,” says Jonas Parby, one of the authors of the report.

–

Joburg.org.za