The road freight industry has experienced ten months of contract declines, on a three-month moving average. It is not as bad as the situation in 2008/09, but it’s extremely bad for Transnet.

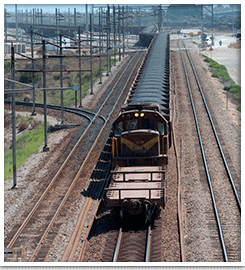

Addressing members of the road freight industry at the Road Freight Association’s annual convention this week, economist Mike Schussler explained to what extent the commodity crunch is hurting the transport sector. He said: “Twenty-foot container transport volumes are around 8% down on a three-month moving average as of April. Imports were really coming down for about six months. There were double-digit declines in the imports side while exports were one or two percent up. The last month or two the export side is down 4.6% on its three-month moving average. Some of our exports, despite the weak rand, are not doing so well. The situation is worse than the big recession of 2008 if you look at what is coming into the ports. “Real bulk commodities through the ports are 5.8% down for the three months to April compared to the same period last year. The figure in March was the worst that we’ve ever had. While coal in April held up, (around 3% on a year ago), iron ore has been totally decimated; three million tonnes in a month went missing. Iron ore has been cut by 30% and is projected to decline further. That and coal are decimating rail transport and the ports.“Transnet is not going to make the money they thought they would. They have already announced their strategy to move into FMCG. Why do you think you’re getting a permit system? It’s because they are under pressure, they are not going to make a profit. Bulk freight is the mainstay of rail transport; there are two profitable lines: the iron ore line and the coal line.

“They did not expect this. If you look at their strategic plan, they are about 40 million tonnes behind schedule. That is about 12% of what they thought they were going to have. And it’s disappearing. They thought that in two years’ time that they’d be doing 300 million tonnes. Now it looks more likely that they’re going to move less than 200 million tonnes. “Truck sales were up in April, which is quite surprising. However, a lot of guys entering the industry now are going to have a very tough time paying those trucks off as the volumes are not there. We’ve been lucky with the petrol price, which has spiked a bit. It is starting to increase as the weaker rand plays its role. Your costs are going to come under pressure. “The next five years are going to be hard. You’re going to have to think differently, you’re going to have to chase different types of customers, you’re going to have to look at your costs, you’re going to have to look at the type of customers you can get, you’re going to have to get proper customers, do a cost analysis, do it properly, get it done, keep on increasing to keep yourself sustainable in a high inflation environment. If you don’t do that, you go under. Auctioneers are sitting up and are waiting for you. They love selling trucks. We are in the perfect storm.”