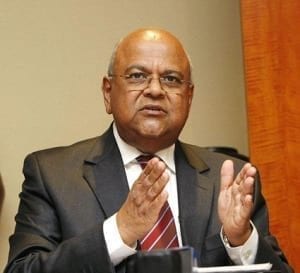

Finance Minister Pravin Gordhan confirmed on Tuesday that SAA had made a loss of R4.7bn in the 2014-’15 financial year.

“We owe it to the South African public that we be honest and frank and truthful about the financial status of the airline.” Speaking in a debate in the national assembly on the challenges facing SAA, Gordhan said reports claiming that the airline made a R4.7bn loss was indeed correct. The financial loss in the 2015-’16 financial year, which was still to be submitted, was projected to be R1.8bn. “SAA is a key state asset. It is worth a lot of money potentially. If it does well it can benefit the state and it will benefit thousands of people who travel on SAA, but also those employed by SAA. The technical staff, the thousands of ground staff, the managers, the crew, the pilots who ensure our safety and the various enterprises that have a business relationship with SAA as well.” Gordhan pointed out that there was a difference between a guarantee and a cash bailout. On Friday National Treasury confirmed that SAA received a R5bn going concern guarantee after meeting with the new board. “Let’s not confuse the public. A guarantee is not the same as a cash bailout. A guarantee means you are in a better position to borrow, but if you default on your payments the state bears the cost. A cash bailout is when you inject equity,” he explained. “It is also correct to say that if we remove government guarantees and government support, technically SAA would be insolvent at this point in time. But it is a public asset. We can’t allow a public asset to go to the ground.”Gordhan said it’s true that SAA has to date received guarantees to the amount of R19bn and that eight to ten banks had offered guaranteed loans to the national carrier.

“R4.5bn of those loans are coming up for payment in the next few months and SAA must either pay this amount or let it roll over. But banks and other lenders will ask questions, such as if SAA is capable of generating the cash to reduce its loan amount.” The board, Gordhan said, must question SAA’s finances and see if the airline does in fact need a cash injection. “But if this is the case, the board would need to prove to government, the public and parliament that they require X or Y amount of money.” Gordhan also noted that according to SAA’s current corporate plan, the national carrier would only be profitable in 2020 or 2021. “And this is moving with each corporate plan. Ultimately what all of us want is an accountable board and airline that can return itself to profitability.” In his speech, Gordhan reiterated the conditions he had set earlier for the R5bn guarantee, such as that the process of appointing a new chief executive and chief financial officer should start as soon as possible, the drafting of a sound business plan and reviewing the existing strategy and reviewing its flight routes. In addition, he also stipulated that the SAA board would need to reconsider all suspensions of staff members in the past months. Myeni earlier suspended SAA’s head of human resources Thuli Mpshe, as well as treasurer Cynthia Stimpel over disagreements.