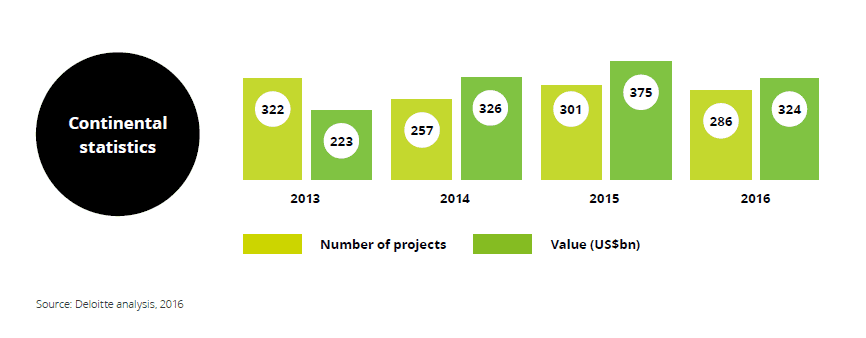

Construction companies throughout Africa have seen a decrease in the number and value of construction projects this year.

He added that global economic headwinds, low growth and lower commodity prices have all contributed to this decrease.

In the company’s latest construction trends report Labuschagne said that the ‘Africa rising’ story has been under pressure and that this has resulted in an uneven focus on infrastructure and capital project development.

“Many governments and the low number of projects highlighted that the private sector is struggling to maintain their spending on infrastructure and capital projects,” he said. Labuschagne explained that new pressures such as drought, security concerns, rapid urbanisation and falling government revenues had made it difficult to maintain the spending in infrastructure required by many countries.

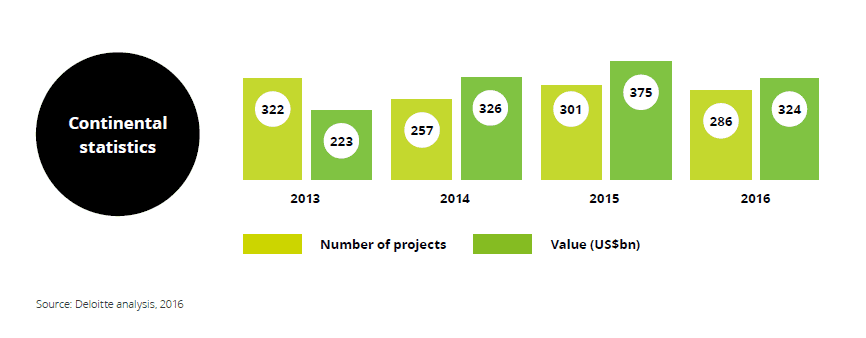

The graph below shows the fluctuation in the number and value of construction projects throughout Africa since 2013:

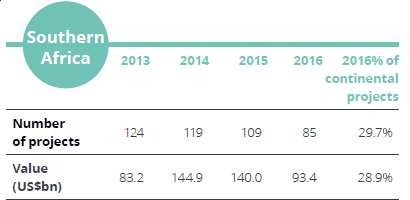

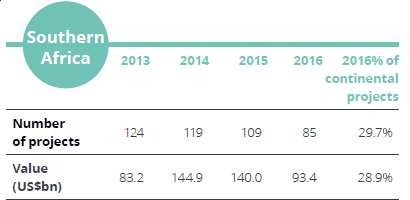

The Southern African region has been the only region on the continent to see a significant decline in the number of construction projects, while the North, East, West and Central regions have increased or experienced fluctuations in the number and value of projects.

The Deloitte report recorded the number and value of projects in Africa in the following sectors for 2016:

- Energy and power industry had 60 projects with a value of US$59.7 bn.

- Transport had 96 projects with a value of US$68.8 bn.

- Water had 11 projects with a value of US$4.3 bn.

- Oil and gas had 13 projects with a value of US$84.6 bn.

- Shipping and ports had 24 projects with a value of US$31.4 bn.

- Social development had 2 projects with a value of US$0.4 bn.

Owning the projects

Governments across Africa own the largest share of projects – 209 projects (73.1%), followed by private domestic companies (33 projects) and the United Kingdom (6 projects). South Africa ranked fourth on the list out of 10, owning 1.7% of projects in Africa.

Funding the projects

Funding statistics remain very similar as government funds the largest number of projects (28.3%), with private domestic companies coming in second, funding 14% of projects, and international DFIs funding 13.6% of projects. South Africa ranked sixth on the list, out of 13 listed funders, and funds 2.8% of construction projects.

Building the projects

Private domestic companies build the largest number of projects (26.6%), with China and Italy building 22.4% and 6.3% of projects respectively, while South Africa (ranking sixth out of 14 builders) builds 3.5%.

Africa’s water crisis and water infrastructure

The report focused largely on the water sector in Africa. “Water plays an important role, which cuts across a number of sectors in an economy,” Labuschagne said.

Issues such as overuse, inadequate water infrastructure and poor water management are major contributing factors to water shortages throughout Africa, the report said.

Although water covers more than 70% of the earth’s surface, less than 0.5% of the world’s water is actually available for use in the form of fresh surface and ground water.

The report said that the World Bank predicted that water scarcity, aggravated by climate change, may spur migration, ignite conflict and cost some global regions up to the equivalent of 6% of their GDP.

“Given Africa’s relatively lower level of economic development compared to other regions, the continent is likely to be the worst affected by a lack of accessible water in the coming years,” the report stated. “The lack of storage, treatment and irrigation infrastructure even with abundant natural water resources results in these resources not being utilised neither effectively nor efficiently across countries.”

As the costs of building new water infrastructure increase, together with the higher cost of operating and maintaining existing water infrastructure, funding for required investments in the sector becomes more difficult.

The report said that the creation of more liberalised water markets was one way to ensure that water utilities, especially in developing countries, have access to sufficient funding to invest in and maintain existing water infrastructure, and importantly noted that governments on the continent should prioritise water projects as more countries move to harness their hydroelectric power potential.

The Southern African region has been the only region on the continent to see a significant decline in the number of construction projects, while the North, East, West and Central regions have increased or experienced fluctuations in the number and value of projects.

The Deloitte report recorded the number and value of projects in Africa in the following sectors for 2016:

The Southern African region has been the only region on the continent to see a significant decline in the number of construction projects, while the North, East, West and Central regions have increased or experienced fluctuations in the number and value of projects.

The Deloitte report recorded the number and value of projects in Africa in the following sectors for 2016: