A tax on carbon dioxide emissions could provide the South African government with enough money to deliver clean running water to every citizen.

The report called, “Modelling the Impact on South Africa’s Economy of Introducing a Carbon Tax”, closely modelled the design features of the tax as outlined in the 2013 Carbon Tax Policy Paper.

The design of the carbon tax aims to reduce greenhouse emissions while also trying to minimise any potential adverse impacts on low income households and industrial competitiveness.

The report indicated that by providing tax-free emission thresholds and allowances, ranging from 60% to 95%, this will result in a relatively modest carbon tax rate, which will range between R6 and R48/tonCO2eq, during the first phase of the carbon tax implementation, until the end of 2020.

Carbon tax to reduce greenhouse gas emissions

The modelling results suggests that carbon tax will have a significant impact on reducing South Africa’s greenhouse gas emissions and would lead to an estimated decrease in emissions of 13 to 14.5% by 2025 and 26 to 33% by 2035, compared with business-as-usual.

The carbon tax would make an important contribution towards reaching South Africa’s Nationally Determined Contribution (NDC) commitments under the recently ratified Paris Agreement. Emissions are said to peak between 2020 and 2025, plateau for a ten year period from and decline thereafter. The carbon tax will also ensure that emissions are reduced while economic growth is sustained.

Carbon tax to decrease economy growth

The carbon tax is expected to lead to a reduction in the annual average growth rate of the economy between 0.05 to 0.15 percentage points, compared to business-as-usual.

Sensitivity analysis shows that the carbon tax would have a similar modest impact even if the economy grows less quickly than expected.

Model overview and assumptions

The study uses the University of Pretoria’s General Equilibrium Model (UPGEM) which is a dynamic general equilibrium model of the South African economy. The model provides a quantitative description of the South African economy, and accounts for linkages and interactions between the various sectors and agents within the economy. The model was also modified to allow for detailed analysis of the impacts of the carbon tax on the electricity generation mix and greenhouse gas emissions.

The analysis relies on a comparison between a baseline scenario and different policy scenarios informed by the tax design. The baseline scenario specifies how the economy is expected to evolve over time without the introduction of the tax or any other regulatory interventions.

This is then compared to the expected change in the economy when a specific carbon tax design and revenue recycling measure is introduced. The difference between the baseline and various policy scenarios provides an assessment of the impact of the policy intervention on the economy.

Two baseline scenarios were considered in this study that is, a main and alternative baseline. The main assumptions for both scenarios are summarised below:

- Main baseline scenario: assumed average annual GDP growth of 3,5% from 2016 to 2035, constant inflation of 5,5% and population growth of 1%.

- Alternative baseline scenario: assumed average annual GDP growth of 2,4% from 2018-2035 .

- Efficiency improvements and technology: No explicit assumptions were made about future efficiency improvements and the cost competitiveness of clean in the electricity generation mix. Technology ratios will not be adjusted year on year.

Scenarios modelled

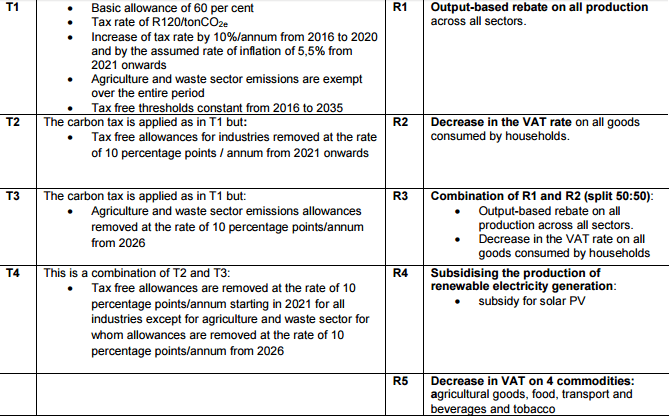

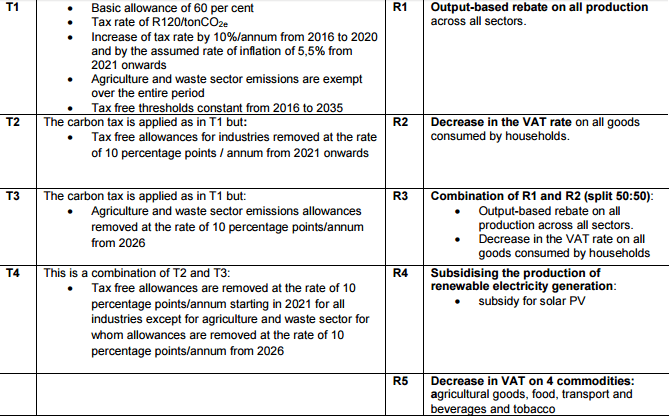

The table below shows tax policy scenarios (T) and recycling scenarios (R):

Due to technical reasons, some of the design features of the tax could not be modelled. This might suggest that the initial impact of the carbon tax might be muted, and result in slightly less greenhouse gas emission reductions and have a lower impact on economic growth.

It is important to note that any possible negative impact from climate change and unabated emissions or benefits from reducing greenhouse gas emissions as well as co-benefits such as lower levels of local air pollution was not factored into the modelling.

Therefore, the model analysis and results likely underestimates the benefits of the carbon tax policy and should not be viewed as an assessment of the overall impact of introducing a carbon tax in South Africa.

Broad findings from the report

The findings from the T2R1 scenario referred to as the ‘focus’ scenario are discussed below. In this scenario the tax-free allowances, as laid out in the proposed design of the tax, are gradually removed at a rate of 10 percentage points per annum for all sectors (except agriculture and waste), and revenues are recycled through a rebate to all firms proportional to their output. The other revenue recycling scenarios, including reductions in the VAT rate and ‘narrow’ recycling measures to a small number of sectors are not as effective at offsetting the impact of the tax on economic activity.

The simulations suggest that the introduction of a carbon tax will contribute significantly to South Africa’s greenhouse gas emissions reduction goals. The analysis shows the estimated reductions of 33 per cent by 2035 compared with business as usual.

The economy will continue to grow whilst emissions are reduced. The modelling results estimate that a carbon tax will reduce the economy’s average annual growth rate by only 0.15 percentage points.

The carbon tax also has a small impact on other macroeconomic aggregates such as employment, consumption and real wages. In the ‘focus scenario’, the annual growth rate in household consumption falls by 0.23 percentage points, employment falls by 0.07 percentage points, and real wages fall by 0.2 percentage points.

Simulation results suggests that concerns over the competitiveness impacts of the carbon tax are overstated as exports could be 3.5 per cent higher in 2035 with the introduction of the carbon tax. This is driven by sectors such as transport equipment, electrical machinery, and textiles and footwear sectors which are expected to experience increases in the annual growth rate of exports of around 7 per cent as a result of the carbon tax plus revenue recycling. In 2035, their exports are likely to be around 30 to 40 per cent higher than in the baseline.

However, certain sectors are projected to experience declines in exports including the coke oven and iron and steel sectors, although in the latter case the sector’s exports continue to grow over the period to 2035, just at a lower rate than if there were no carbon tax.

There will be a number of important sectoral winners and losers from the carbon tax and these are consistent with the objective of the carbon tax of promoting structural change. In 2035, the output from the nuclear, wind, hydro, gas and solar photovoltaic power generation sectors is expected to be more than 200 per cent greater than without a carbon tax. These low carbon sources of power will become much more cost-competitive with a carbon tax. Coal generation becomes less cost competitive with its output expected to be 46 per cent lower in 2035 than it would be without the tax.

Other sectors that could experience a decline in output relative to the baseline include petroleum refining, other manufacturing, coke production and the electricity supply sector. However, it should be stressed that this is a relative decline in output compared with the situation in which there is no carbon tax. All of these sectors are projected to grow in absolute terms by between 18 (coal generation) and 105 (other manufacturing) per cent over the period 2014 to 2035 even with a carbon tax.

The method of revenue recycling was found to be an important driver of the results. The analysis shows that a carbon tax with persistent tax-free allowances will yield substantially lower emissions reductions, but also have a smaller negative impact on GDP growth. The analysis suggests that broad, production based recycling such as the producer focused rebates is likely to yield smaller impacts on GDP but also less significant emissions reductions, whilst a narrow, clean energy focused support will lead to substantial decreases in emissions but a lower growth rate for the economy. The current design of the carbon tax include elements of broad based (electricity generation levy credit) and targeted support measures for low income households.

The common key finding of all the modelling studies conducted to date on the carbon tax is that the introduction of a carbon tax will contribute significantly to SA’s greenhouse gas emissions reduction goals and will only have a modest negative impact on economic growth and other macroeconomic aggregates such as employment, consumption and real wages over the medium term.

The ratification of the 2015 Paris Agreement emphasises the reality that we will have to prepare to operate in a carbon constrained economy over the medium to long term. A business as usual scenario is no longer an option and we must take appropriate and proactive actions to help transition our economy onto a low carbon growth path as articulated in the National Development Plan. The carbon tax, together with the carbon offsets, is an important and cost effective instrument, as part of a package of measures, to nudge our economy onto a more sustainable growth path in a just way.