GGIF will also have a Public Private Partnership (PPP) unit that will focus on developing viable projects in collaboration with government agencies.

The World Bank and Ithmar Capital said that it would work closely with a range of public and private investors, including regional development banks, sovereign wealth funds, and global and regional institutional investors. It added that these partnerships would help increase private capital participation in green infrastructure investments across the continent. The GGIF will also focus on reducing the risk of marginally non-bankable projects in order to help them materialise by using innovative mechanisms for project preparation and capital structures. The fund has already received support from the chair of the International Forum of Sovereign Wealth Funds, which recently launched its first working group dedicated to climate change.

The first pan-African fund dedicated to green investment in Africa was established this week at the Finance Summit of COP22 in Marrakesh, Morocco.

The World Bank Group and Ithmar Capital, a Moroccan sovereign investment fund, signed the memorandum committing to the establishment of a Green Growth Infrastructure Facility for Africa (GGIF).

The facility will focus on attracting private investors who are looking for responsible and green investment opportunities in Morocco or other African countries.

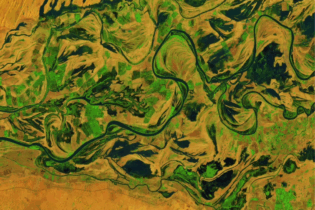

The GGIF plans to help boost Africa’s transition to a green economy by supporting low carbon infrastructure such as clean energy, low carbon transportation and the efficient utilisation of water resources.

GGIF is structured as a private capital fund. The involvement of the World Bank and Ithmar Capital will benefit the fund as it will have the expertise in fund establishment and policy work of the World Bank at its disposal, as well as Ithmar Capital’s network of partners and experience in co-investment structuring.