Scrap metals market

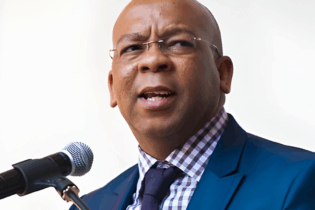

Keith Anderson, chairman of eWASA says, “The e-waste generated in 2014 contained an estimated 16 500 kilotonnes of iron, 1 900 kilotonnes of copper, 300 tonnes of gold (equivalent to 11% of the world’s total 2013 gold production), as well as silver, aluminium, palladium, plastic and other resources with a combined estimated value of US$52 billion.” He adds that the bulk of South Africa’s e-waste is created by national and provincial government, who are responsible for creating 45%% of the country’s e-waste. Business produces 35% and households produce 20%. A recent CSIR report has indicated that 25 jobs are created per 1000 tonnes when this type of scrap is properly processed. Currently, South Africa exports 90% of its printed circuit boards – one of the most valuable e-waste components. Sources include Miningmx, Ewasa and the CSIR

UPDATE: Heavy non-ferrous fractions of material left over after shredding and processing large automotive or e-waste scrap components still hold value. A tonne can contain up to 20 g of gold and up to 300 g of silver, as well as platinum group metals (PGMs) and other precious metals.

Operators overseas report earnings equivalent to about R47 000 per tonne just from selling the heavy fraction. Machinery and equipment that separate these metals into the light and heavy fraction.

South African platinum

In the platinum market, South African companies are realising this value to the extent that they are investing in US automotive scrap metals recycling companies.

For example, Miningmx has reported that South African Platinum mining company, Northam Platinum, has acquired PGM facility from A1-Specialised Services in the US at a cost of R139-million.

According to the website: “This is the second investment by a South African company in platinum recycling this year, after Sibanye Gold bought Stillwater Mining, another US company with a large presence in the PGM recycling market.”