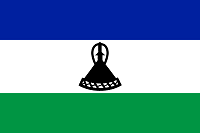

Lesotho’s entire petroleum requirements are met through imports as the country does not have any established reserves of crude oil. The country is a mountainous enclave surrounded entirely by South Africa.

Ninety-five percent of its fuel is imported from South African based multinational oil companies. There are five importers and marketing companies involved in the distribution and retailing of petroleum products, these being Chevron, Engen, Total, Shell and BP. Wholesale petroleum prices are regulated by the LPF (Lesotho Petroleum Fund). Prices are regulated on a monthly basis and the country is divided in four country zones due to the difference in the transport terrains. The fuel price only differs by 3% among the four zones. Pricing of Petroleum ProductsThe reliance of the country on oil products from South Africa simply means that the world market oil price increase automatically flows through to Lesotho’s internal fuel price structure. The country pays premiums on all charges from South Africa on all oil products to help finance the Sasol Synthetic fuel plants. As in South Africa, The Ministry of Energy controls the price of fuel at a higher level but the Lesotho Petroleum fund is the organ instructed to regulate the monthly fuel price. Unfortunately, we can only speculate on the fuel price structure as this information is not available to the public. Calculation of Pump price

Considering the fact that fuel is imported, the South African fuel price calculation, demonstrated in the table below, is applicable. However a Lesotho Petroleum Fund fuel subsidy makes it affordable for the local market. Fuel consumption grew significantly between 2006 and 2010.

Diesel is clearly subsidised by the Lesotho Government – although Lesotho imports all its refined diesel it is still cheaper than South African diesel which supplies the fuel.

Similarly, it is apparent that petrol is also subsidised by the Government. The significant drop in the fuel price is largely due to:- The focus by OPEC producing countries on increasing their market share

- Slow and deteriorating EU economies and the slowing of Asian economies, leading to a significant reduction in demand levels

- Significant growth in the U.S. domestic crude oil production

Given the current situation, and taking into account the brent crude oil predictions and currency exchange factors, Eqstra anticipates that the Lesotho fuel price will increase between 7 – 8% until December 2015. It recommends that an annual inflation of at least 7% is budgeted for fuel in 2015. The company recommends that you review your fleet mix and operational costs at least every two years to ensure you optimise cost and efficiency within your fleet.