The acquisition of Kenzam Equipment to form Ammann Kenzam as a wholly owned entity of the Ammann Group represents a major milestone in the Swiss OEM’s ongoing penetration of the African market.

The fact that Ammann has been in existence since 1869 says everything about the Group’s sustained focus on strategic growth, and the formation of Ammann Kenzam underscores this,” says Rocco Lehman, managing director of Ammann Kenzam. “As in other parts of the world, it’s been an evolutionary process with far-reaching benefits.” Lehman was responsible for establishing and heading up Ammann South Africa in 2010 to grow the OEM’s presence in the Southern African region for its road construction and allied machine range, as well as its batch and continuous asphalt mixing plants – both mobile and static. ELB Equipment was appointed as the dealer for its machine line, which includes compaction and paving products, while Ammann South Africa remained the direct customer interface until the appointment of Kenzam Equipment as its asphalt plant dealer in May 2020. Kenzam partnership strengthens OEM capabilities “Key motivating factors for appointing Kenzam Equipment as a dealer included their expert knowledge of the bitumen and asphalt market, with a proven track record in South Africa and Africa. Even more importantly, however, is the fact that Kenzam Equipment is a well-established and respected OEM in this field,” Lehman continues. Based in Gauteng, South Africa, Kenzam Equipment specialises in the design and manufacturing of bitumen handling and storage systems, as well as fuel transfer, storage and fire protection equipment. Allied services include custom design, build and retrofit solutions for new and existing asphalt plants, plus plant installation and commissioning services. Products produced by Kenzam Equipment include bitumen drum decanting units, bunded containerised bitumen storage tanks, cylindrical vertical and horizontal storage tanks, and bitumen pumping units. A number of these products are similar to those produced under Ammann’s Complementary product range, which includes solutions like mobile laboratories, as well as bitumen processing, storage, and heating systems. An example includes the Ammann DrumTEK line of bitumen drum decanters. “In addition to enhancing customer service, having a local fabrication capability in South Africa to support Ammann regional developments was seen as a major strategic advantage,” Lehman explains.

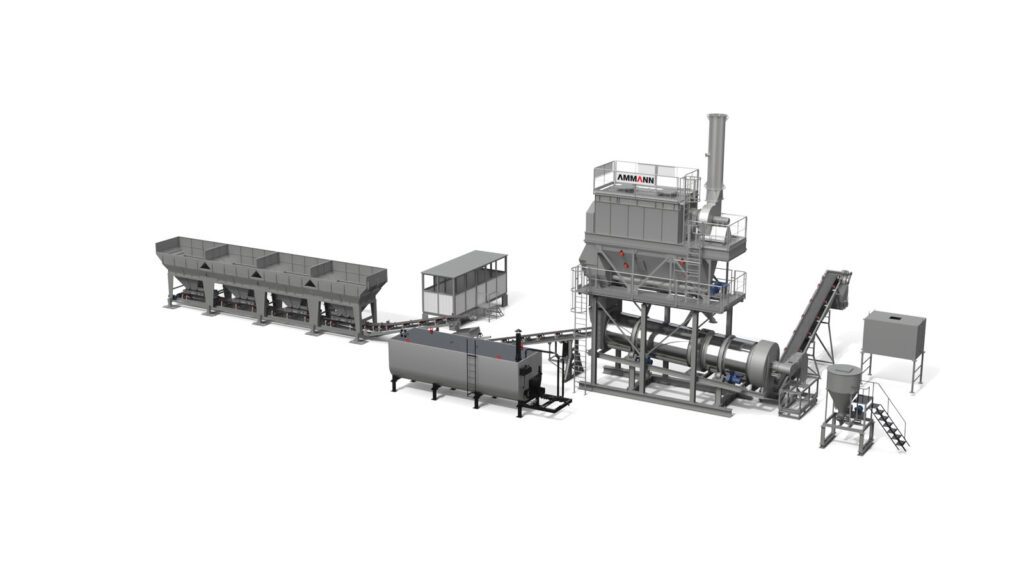

niche market focus Depending on the product and market, machines and asphalt plants are manufactured globally at Ammann facilities based in Switzerland, Czechia, Germany, Italy, China, Brazil and India. “The cross-pollination of research and development (R&D) within the Group means we can design products that meet specific country or regional requirements, without compromising on Ammann’s 153-year legacy for innovation and excellence,” Lehman explains. “Markets in South Africa and Africa, for example, are far more price sensitive, while durability and ease of maintenance are other key requirements. For this reason, Ammann fields premium and value lines, and both have the same R&D DNA. For customers, the advantages include more straightforward processes and the ability to further customise with high-tech options,” Lehman continues. Developing a value line was one of the key reasons for the Ammann Group’s initial joint venture and subsequent acquisition of Indian OEM, Apollo, to form Ammann India. During 2014 and 2018, Ammann invested some €95 million (R1.69 billion) in upgrading the original Apollo factory based in Mehsana, near Ahmedabad, to bring it in line with Ammann production standards globally. Today, the 120 000 m2 facility manufactures Ammann asphalt and concrete mixing plants, as well as Ammann asphalt pavers and compactors, destined for key markets like Southern Africa. Examples of asphalt plants produced in Mehsana include the Ammann ValueTec range (80-260 tph [tonnes per hour]) and the CounterMix series (90-120 tph). The latter combines the simplicity of continuous drum-mix plants with exceptional fuel efficiency, thanks to counterflow technology. Meanwhile, ValueTec batch plants meet the requirements for cold or hot reclaimed asphalt feeds, together with either liquid or solid additives. Alongside its ValueTec and CounterMix offering, during 2023 Ammann Kenzam will also be introducing the EcoTec (120 tph) batch plant into Southern Africa for the first time. A more affordable version of the ValueTec, there are currently two EcoTec plants operational in other parts of Africa. Static versus mobility Within the evolving market, mobile asphalt mixing plants are also gaining in popularity, particularly for shorter-term contracts where the cost of erecting a static plant is not justified. Mobile plants are also ideal for remote projects where haulage distances from fixed batch plants are too great. In terms of mobility, Ammann has led with innovative solutions that include its ACM 100, 140 and 210 PRIME line, with production outputs of 100, 140 and 210 tph respectively. These plants, which are produced at Ammann’s factory in Brazil, are mounted on integrated trailers for towing by a truck tractor. The downside is that this Brazilian configuration setup is not currently road legal for South Africa without a rigorous homologation process, which entails mechanical modification. However, as the saying goes, “Where there’s a will, there’s a way.” So, Ammann and Kenzam Equipment put their heads together to engineer a solution. In August 2022, this led to the launch of an Ammann CounterMix 120 unit mounted directly on to currently available road-legal trailer configurations in South Africa, ruling out the need for a homologation process. While the modular mobile trailer solution is custom built, the CounterMix 120 plant is 100% standard in accordance with Ammann’s OEM specifications. “It’s an innovative breakthrough that has been celebrated throughout the Group as an example of out-of-the-box thinking – setting a new benchmark for Ammann mobility – and we’ve received a very positive response from the industry,” says Hurst, adding that the first mobile CounterMix 120 has already been sold to a Zimbabwe-based contractor, Exodus & Company. Customers can order the basic asphalt plant only, or include allied elements like bitumen tanks and decanters, each of which will be mounted on its own separate trailer. The ValueTec proposition The Ammann Group’s gains to date have been founded on remaining flexible, responsive and taking a long-term view guided by detailed market intelligence. The foresight of acquiring Ammann India is a prime example, which is yielding major dividends as the Mehsana factory continues to support Ammann Kenzam’s ability to field quality plants at competitive pricing. Recent Ammann Kenzam sales in the past 12 months include four Ammann ValueTec static batch plants sold into the DRC. These comprise a ValueTec 180, two ValueTec 140s and a ValueTec 80. An Ammann ValueTec 140 has also recently been sold in Zimbabwe. “The Ammann ValueTec series is a bestseller, with the core design sharing the same features as Ammann’s premium plant range produced in Europe. As per the product name, the ValueTec focuses on the essentials to offer exceptional value in terms of acquisition costs, as well as passing on significant operational savings in terms of greater efficiencies,” says Lehman. Within the Africa Middle East region, Egypt has been a major growth market for the ValueTec brand, with 16 plants – ranging from 140s to 180s – sold by the local Ammann dealer during 2021 to support infrastructure development in Africa’s third largest economy. “The history of Ammann is one of vision, innovation and excellence around the globe. The formation of Ammann Kenzam now opens a new chapter in the Group’s evolution in Southern Africa and Africa, which are among the world’s fastest growing regions,” Lehman concludes.