Investment in infrastructure is crucial for South Africa’s and Africa’s socio-economic development. IMIESA talks to Njombo Lekula, Managing Director, PPC RSA, about the company’s visionary role in ensuring sustainable capacity while steadily transitioning to a net-zero future.

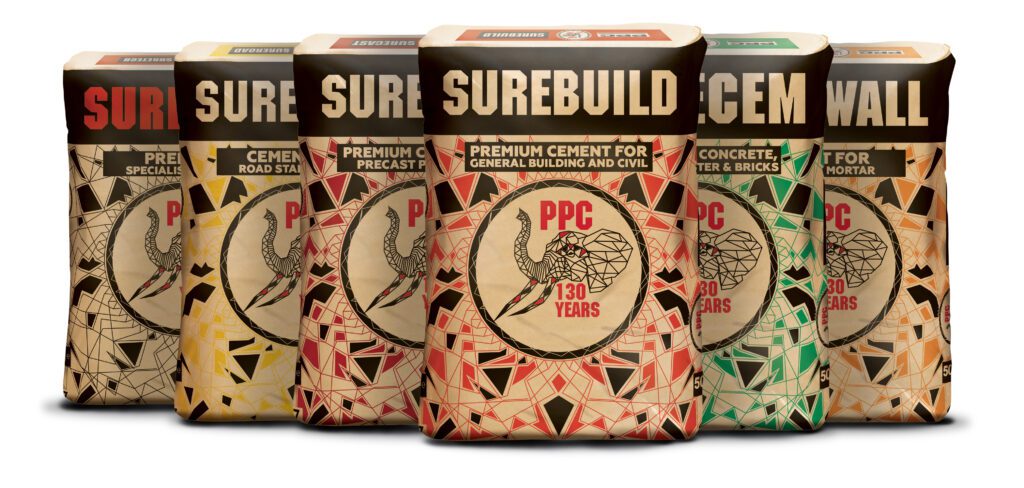

How is PPC responding to the quest for sustainability? NL We’ve taken the decision to lead by example within the African continent where we operate. We’re well placed to do this, as South Africa’s largest Portland cement producer, as we celebrate our 130th year in business in 2022. We have a substantial footprint, with 11 cement factories in South Africa, and operations in Botswana, the DRC, Ethiopia, Rwanda and Zimbabwe. We need to understand the challenges posed by climate change and respond meaningfully within the context of Africa’s development agenda. This was a key motivation for the compilation of the inaugural PPC|GIBS Building Africa Report 2022, an overview of which was presented at the African Smart Cities Summit in June 2022. Climate change is a reality, as is the pressing need to meet the UN Sustainable Development Goals. In a world of rapid change, PPC recognises the need to respond proactively within our spheres of operation, while remaining relevant and profitable. The PPC|GIBS report addresses the realities of and opportunities for achieving carbon neutrality within an evolving market for cement on the continent. What are some of the key highlights in the report? Essentially, the report – compiled in conjunction with GIBS’s Centre for African Management and Markets – is futuristic and looks beyond cementto consider what sustainable and smart construction will look like for the next generation. The full report (which can be downloaded at

www.ppc.africa) sets the scene with an overview of the major players in the African cement market. Other points considered include the growth potential for African infrastructure, the African Continental Free Trade Area, the legislative environment, funding mechanisms and the need for inclusivity. There are also fascinating case studies using hybrid concrete. Africa is a vast continent of 55 countries and more than

2 000 living languages, which makes it a complex trading environment. As highlighted in the report, investment in African infrastructure has remained constant, at just over 3.5% over the past decade. By comparison, China’s spend is more than double that percentage. Even more revealing, cement consumption in China between 2011 and 2013 was greater than that consumed by the USA in the entire 20th century. So, for Africa to catch up, there needs to be a major ramping-up and far greater collaboration. That includes reducing cement imports and growing local capacity. Africa’s ability to move projects to financial close is one of the major stumbling blocks, rather than the availability of funding. According to the report, some 80% of infrastructure projects fail at the feasibility and business plan stage. Part of the solution, as in South Africa, is an increased focus on public-private partnerships. Another key enabler is policy certainty and good governance. This will further facilitate investment by cement producers in new markets, and inter-country African trade – given improved supply chain logistics, transportation and customs agreements. Going forward, South Africa and Africa must embrace the Fourth Industrial Revolution to remain globally competitive. What are some of the main takeaways in the report for PPC? PPC demonstrated its strategic commitment to sustainability with the release of its first Task Force on Climate-Related Financial Disclosures (TCFD) report in November 2021. Interventions include how we will manufacture cement in future, including interventions like artificial intelligence to enhance efficiencies. How we include renewables in our energy mix is another area of investigation. We believe PPC can be carbon compliant while pushing the boundaries towards net-zero. However, that will require intensive technological development and investment – a prime example being the incorporation of carbon capture and storage solutions.

How is PPC addressing carbon neutrality?

The global decarbonisation debate focuses on finding solutions. Many argue that it’s a delicate balance between putting economies and people, or the environment, first. Essentially, you cannot separate the two. We acknowledge that it’s going to be a major challenge for the world to meet the UN 2050 carbon-neutrality target (net-zero). We know a collective response to climate change is essential. However, the roadmap must be realistic. Our starting point was to see the need for change as an opportunity, rather than a forced and punitive measure. PPC has set out on its journey to achieve a greener transition by progressively adding new technologies and processes. These will be ramped up over time and incorporate new innovations as they come to market. An example is green hydrogen as an alternative fuel source. While still in its infancy, green hydrogen is certain to accelerate in its development and adoption, with South Africa emerging as one of the leading producers. Going forward, PPC’s executives have drawn up a timeline running between now and 2030. We’ve set challenging targets that we believe are measurable and achievable. The 2050 objectives set out in our TCFD will be led by the next generation of PPC leadership. They will have a great foundation to build on.