Nearly two-thirds of South African business executives are delaying their investment decisions while almost half are considering investing offshore due to uncertainty regarding the future political direction of the country.

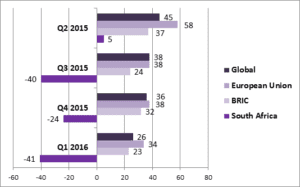

This is according to first quarter research from Grant Thornton for 2016. Grant Thornton Pretoria’s managing partner, Johan Blignaut, believes that the shaky end to 2015, as Finance Ministers were reshuffled coupled with early January ‘Nkandla issues’ were probably core contributors to this statistic. “Following a settling of South Africa’s currency since the National Budget Speech by Minister Pravin Gordhan in February, and with Parliament issues gradually stabilising, we hope that the political climate will settle during Q2 this year as this certainly would go a long way to making our country stronger and more competitive overall,” Blignaut says. In terms of optimism for the outlook of South Africa’s economy in the coming 12 months, South African privately held businesses are very pessimistic expressing negative 41% in an optimism survey. How optimistic are you for the outlook of your country’s economy over the next 12 months? [Source: Grant Thornton International Business Report (Q1 2016)]

“Amid fears of a credit rating downgrade for South Africa to junk status and currency declines since December last year, South African businesses are battling to keep their heads above water,” continues Blignaut.

Three-year low

For the first time since Q4 2012, global business optimism fell to a three-year low, at 26%, in the first quarter of 2016. A potent combination of fragile financial markets, volatility in oil prices, concerns over terrorist attacks and regional issues including the prospect of a Brexit and the US Presidential race resulted in the majority of regions uncertainty in their economic outlook.

The trend is evident across the globe, including the G7 (down 7 percentage points in Q1), EU (down 4pp), North America (down 6pp), Latin America (down 16pp) and Asia Pacific (down 10pp).

[Source: Grant Thornton International Business Report (Q1 2016)]

“Amid fears of a credit rating downgrade for South Africa to junk status and currency declines since December last year, South African businesses are battling to keep their heads above water,” continues Blignaut.

Three-year low

For the first time since Q4 2012, global business optimism fell to a three-year low, at 26%, in the first quarter of 2016. A potent combination of fragile financial markets, volatility in oil prices, concerns over terrorist attacks and regional issues including the prospect of a Brexit and the US Presidential race resulted in the majority of regions uncertainty in their economic outlook.

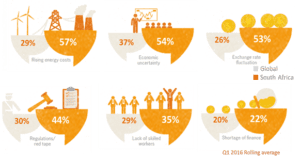

The trend is evident across the globe, including the G7 (down 7 percentage points in Q1), EU (down 4pp), North America (down 6pp), Latin America (down 16pp) and Asia Pacific (down 10pp).South African business growth is constrained The increasing cost of energy is the biggest constraint to growth and expansion for South African business executives (Q1 2016: 57%). 54% of businesses stated that economic uncertainty was limiting growth for business, while 53% stated exchange rate fluctuations as a key constraint. Overregulation and red-tape is the nation’s fourth greatest constraint to business expansion with 44% of SA businesses stating this factor while a lack of a skilled workforce is constraining 35% of business executives’ growth plans.

“At a time when businesses are focused so much on containing excessive costs, rising energy prices are a massive burden and its effect on business growth will definitely be felt,” says Blignaut.

Impact of poor government service delivery

When business executives were asked if their companies had been negatively impacted by poor government service delivery, 69% of respondents said yes.

86% of South Africans stated utilities as the key government service delivery issue affecting their businesses (Q1 2015: 83%). The second biggest issue for organisations in the Q1 IBR survey was strikes by government employees with 65% of respondents lamenting this issue (Q1 2015: 20%).

“At a time when businesses are focused so much on containing excessive costs, rising energy prices are a massive burden and its effect on business growth will definitely be felt,” says Blignaut.

Impact of poor government service delivery

When business executives were asked if their companies had been negatively impacted by poor government service delivery, 69% of respondents said yes.

86% of South Africans stated utilities as the key government service delivery issue affecting their businesses (Q1 2015: 83%). The second biggest issue for organisations in the Q1 IBR survey was strikes by government employees with 65% of respondents lamenting this issue (Q1 2015: 20%).

The two issues of roads and billing concerns seem to be declining in terms of factors which are negatively affecting businesses.

“At present South Africa’s business landscape is uncertain and our economy is struggling along. A common feature in the stories of the most dynamic and successful firms is that they don’t let the noise from these external factors out of their control distract them from looking at their own operations, and they continue to invest in the pursuit of growth years down the line. That may appear easier said than done at the moment, but without investment now, businesses will find themselves behind the curve when conditions overhead improve,” Blignaut concludes.

The two issues of roads and billing concerns seem to be declining in terms of factors which are negatively affecting businesses.

“At present South Africa’s business landscape is uncertain and our economy is struggling along. A common feature in the stories of the most dynamic and successful firms is that they don’t let the noise from these external factors out of their control distract them from looking at their own operations, and they continue to invest in the pursuit of growth years down the line. That may appear easier said than done at the moment, but without investment now, businesses will find themselves behind the curve when conditions overhead improve,” Blignaut concludes.