Report Paints a Gloomy outlook for Kenya…..

According to the African Economic Outlook (AEO) report of 2012, East African countries will realize a decline in GDP at 5% in 2012 down from 6% in 2011. This deep in growth is as a result of the unpredictable duration of Euro-zone crisis, a sluggish recovery in USA and signs of slower growth in China. A prolonged crisis is likely to lead to lower earnings from exports and tourism, lower inflows of official development assistance, foreign direct investment and worker’s remittances. The report projects a growth of 5.6% for East African economies in 2013. These figures are notably above the projected growth for Africa at 4.5% and 4.8% for 2012 and 2013 respectively. While grim on the international outlook, the report projects a resilient African economy in the face of global decline in 2009. However, poor economic performance of the global economy will most likely have a dampening effect on the overall African economy. Instructively, the report notes that although Eastern Africa receives the continent’s lowest Foreign Direct Investment (FDI), it attracts more diversified investment which has resulted into increased productivity. In order, therefore, to attract more investment in services and develop the local consumer market, it will be imperative for the region’s economies to ensure sustained increase in GDP per capita and promote growth of an educated workforce.In 2010/2011, there was increased intra-regional trade among East African countries but lopsided towards Kenya. The increased activity is consequent to the adoption of the Common Markets Protocol in 2010 notwithstanding the slow pace of transition. Kenya, in particular, noted remarkable improvement in regional and international trade. In 2011, the value of imports increased by 21.1% from USD 11 283 million in 2009/10 to USD 13 659 million in 2010/11. In 2010/11 the share of imports that Kenya sourced from African countries accounted for 11.6% while 88.4% came from the rest of the world with Asia as the biggest beneficiary. The imports were mainly sourced from the United Arab Emirates (13.0%), China (12.1%), India (11.6%), South Africa (5.8%), Japan (5.1%), United Kingdom (4.6%) and Singapore (4.0%). Imports from the EAC region accounted for 2.2% of total imports while imports from the COMESA region accounted for 3.9% of total imports. The major import products for the year to June 2011 were oil, manufactured goods, chemicals, machinery and transport equipment.

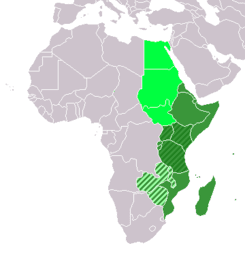

The increase in the value of imports was mainly due to imports of oil, machinery and transport equipment, and manufactured goods. Oil imports accounted for 24.2% of the total import bill in 2010/11 compared with 23.3% in 2009/10. Imports of machinery and transport equipment accounted for 28.9% of total imports, and increased from USD 3 212 million to USD 3 942 million. Imports of manufactured items, mainly intermediate goods, accounted for 14.8% of the import bill and increased from USD 1 625 million to USD 2 021 million while chemicals accounted for 13.5%. In 2010/11, 47% of all the exports went to African countries while 53% went to the rest of the world. The main destinations for Kenya’s exports were Uganda (14.6%), United Kingdom (9.2%), Tanzania (8.0%), Netherlands (6.5%), United States of America (5.6%), Sudan (4.6%), Pakistan (4.2%), Egypt (4.1%) and United Arab Emirates (4.1%). Exports to the EAC accounted for 26.4% in 2010/11 while exports to the Common Market for Eastern and southern Africa (COMESA) region accounted for 34.6% of total exports in the same period.