Chinese funding of energy and infrastructure projects in Africa has almost trebled between 2016 and 2017 from US$3 billion to US$8.8 billion.

This is according to new research by from global law firm Baker McKenzie and IJGlobal. According to the report almost half of the total US$19 billion of Chinese outbound loans poured into infrastructure projects in sub-Saharan Africa since 2014 were made last year. Notably, Chinese lenders accounted for more than 40% of all infrastructure finance in sub-Saharan Africa in 2017 and its policy banks made more the four fifths of lending by Development Finance Institutions (DFIs) in the region. Chinese commercial and policy bank lending for infrastructure projects in sub-Saharan Africa totalled US$3.6 billion in 2014, US$3.4 billion in 2015 and US$3 billion in 2016, before spiking almost 300% to US$ 8.8 billion in 2017, driven by a series of large power projects across Africa.A shift towards power

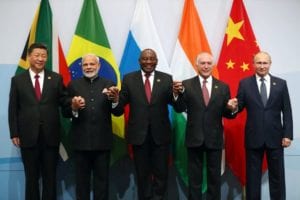

Speaking from the BRICS Energy event, which preceded the BRICS Summit, Kieran Whyte, Head of Energy, Mining and Infrastructure at Baker McKenzie in Johannesburg, said the data clearly shows that Chinese lending is shifting towards the power sector.“This is much more sophisticated outbound lending than the cliché about China investing in African minerals and rail to get commodities to China to feed manufacturing – the data clearly shows Chinese lending predominantly shifting towards African power projects,” he said.

Whyte explains that this shift towards power is because China is comfortable operating in the energy sector and is aware power acts as a catalyst for the growth of other sectors in Africa, providing foundations for long term economic development. “It’s also true that in terms of infrastructure development, many of China’s construction companies are world leaders in the power sector and Chinese goods and equipment are used in the construction process, which further benefits China’s economy,” he said