Africa’s Institutional Capital is Powering the Next Wave of Infrastructure Growth

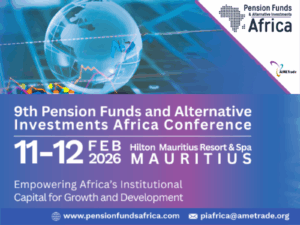

Africa faces an infrastructure financing gap of over USD 100 billion annually – yet its USD 2 trillion in pension and sovereign wealth fund assets hold the potential to bridge it. At PIAfrica 2026, over 200 senior decision-makers from 25+ countries will gather to explore how institutional investors can drive long-term, sustainable development through infrastructure, private markets, and impact investments. PIAfrica will run from 11 – 12 February 2026, at the Hilton Mauritius Resort & Spa, under the theme: “Empowering Africa’s Institutional Capital for Growth and Development”.Mobilizing Capital. Building Africa’s Future.

From Nairobi to Lagos to Gaborone, pension and sovereign wealth funds are redefining Africa’s investment landscape:

- Kenya’s KEPFIC is pooling pension assets to finance infrastructure and housing projects.

- Nigeria’s Pension Commission (PenCom) continues to open pathways for private equity and alternative investments.

- Namibia and Botswana are collaborating with DFIs to finance renewable energy and regional infrastructure.

Key themes include

- Unlocking Infrastructure Finance – Mobilizing institutional capital for high-impact projects

- Agile Regulation & Governance – Aligning pension and SWF frameworks with emerging markets

- Sustainable & Impact Investing – Balancing ESG goals with long-term value

- Trustee Empowerment – Strengthening capacity and decision-making.